Review credit limits for customers

Overview:

- Learn how to review credit limits for your customers

Why review credit limits for customers?

As an accountant in the business, it is important to regularly assess and adjust credit limits to help your business to manage financial risks such as customer payment failures, support customer relationships and maintain healthy cash flow.

Note: It’s best practice to have a documented credit policy in place to guide your business. You may need to establish criteria for extending credit, credit limits, payment terms, and the consequences of late payments and regularly review the policy.

How to review credit limits for customers?

Note: Consider factors such as the customer's payment history, financial stability, business growth, and any industry-specific risk indicators.

Here are steps you can take to review credit limits:

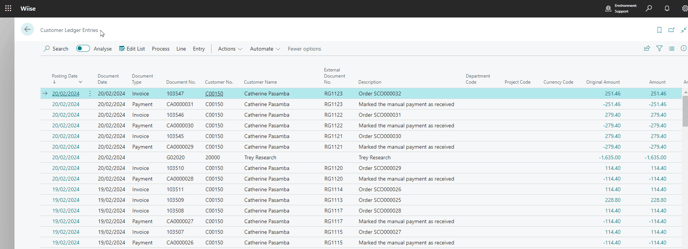

- Search for Customer Ledger Entries on the top right-hand corner of the page or select a Customer Card and access the customer specific ledger entries.

Note: You can review all the payment entries based on the filters you apply. Drill down into a payment entry by selecting the hyperlinked amounts. You can find detailed records of the customer’s financial transactions, including payments.

Note: Set a regular schedule for credit limit reviews. The frequency of reviews can vary depending on factors such as customer risk, transaction volume, and industry norms. - Gather customer Information:

- Communicate with the receiving and sales team to collect up-to-date information on each customer, including financial statements, credit reports, payment history, and any relevant changes in their business circumstances.

- Communicate with customers during the credit review process. Inform them of the review and discuss any changes to credit limits.

- Document the rationale behind any adjustments to credit limits.

- Monitor Payment Performance:

- Evaluate how customers have been meeting their payment obligations. One of the reports you can analyse this is to run the aged accounts receivable report.

- Review any changes in the customer's business, such as expansions, contractions, or changes in ownership.

- Note: Late payments or changes in payment patterns may require a review of credit limits. Adjust credit limits as needed.

- Educate internal staff:

- Ensure that staff are aware of any changes in credit limits. This helps prevent misunderstandings and ensures that teams are aligned with credit management policies.

- Continuous Monitoring:

- Implement ongoing monitoring mechanisms to track customer credit performance between scheduled reviews. This allows for timely identification of potential issues and prompt action.

- You’ve completed the credit limit review for your customers.

What’s next?

Find out how you can review and approve credits so your staff can process credits for your customers.

Need more help?

No problem, that's what we're here for. Reach out to support@wiise.com anytime you can't find what you're looking for.