Write off a bad debt

Overview:

- Learn how to create a provision for bad debts

- Learn how to write off bad debt in Wiise

- Learn how to recover written off bad debts

Why write off a bad debt?

When your customer fails to pay a debt, you’re unlikely to recover the full amount owed. In such cases, you may choose to create a provision for doubtful or bad debts. This provision can be used to write off the customer account when you have confirmed that the customers would no longer pay what is owed.

How to write off a bad debt?

Note: When accounting on a cash basis, no adjustment is required as income is only recognised when you've been paid.

A provision for bad or doubtful debts can be created by estimating the bad debts using a measurement principle. At every month end, you can estimate the bad debts and take up relevant accounting entries to create this provision.

Note: You can write off a customer's account as bad when you know you will not be able to collect any funds from them.

How to create a provision for bad debts?

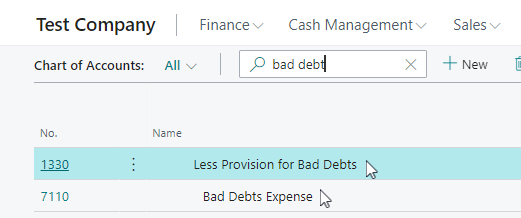

- To provide for bad debt, your Wiise chart of accounts must be setup with a Bad Debt Expense account and Less Provision for Bad Debts account.

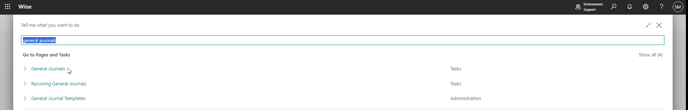

Tip: Based on the aged accounts receivable report, refer to your company policy to estimate doubtful debts and calculate the amount required in your provision account. You can update your provision, either by reducing or increasing it as you progress from one month to the other. - Search for General Journals at the top right-hand corner of the Wiise page.

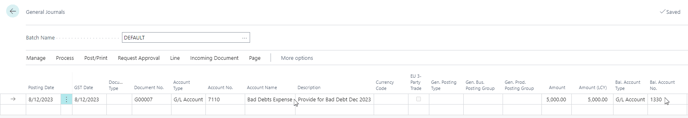

- The General Journals task is displayed below.

- Select the appropriate Account No. to expense the bad debts.

- Select the appropriate Bal. Account No as the provision for bad debt account.

- Fill in the estimated bad debt amount in Amount.

- Provide a narration on the Description column on the action you’re taking. Example: ‘Provide for Bad Debt Dec 2023.’

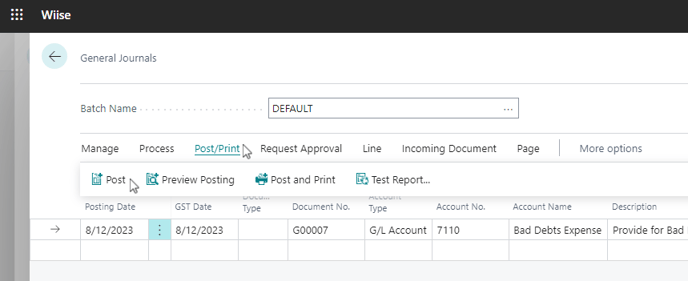

- Post the General Journal. Select Post/Print. Then, select Post.

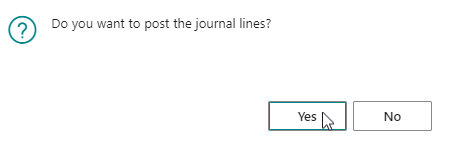

- ‘Do you want to post journal lines’ message appears. Select Yes to proceed or No to stay on the page.

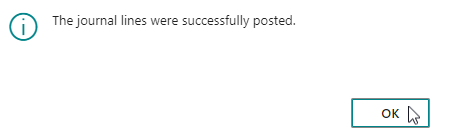

- When the journal lines have been posted successfully, the below information appears.

- Select OK to continue.

- The General Journals task is displayed below.

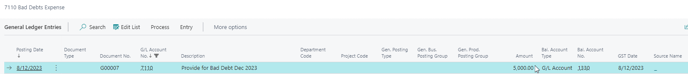

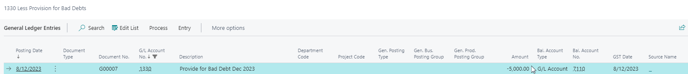

- Now that you’ve posted the general journals for bad debt expense, your chart of accounts will reflect that change on the general ledger entries.

How to write off a customer's account as bad?

Note: You can run the aged accounts receivable report to determine which customers would not pay what they owe. Some of the reasons for non-payment would be bankruptcy or administration type of events.

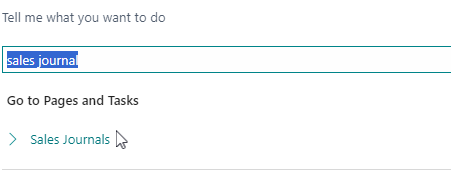

Note: You can use a sales journal or a general journal to complete this process. We’ll use a sales journal for this process.

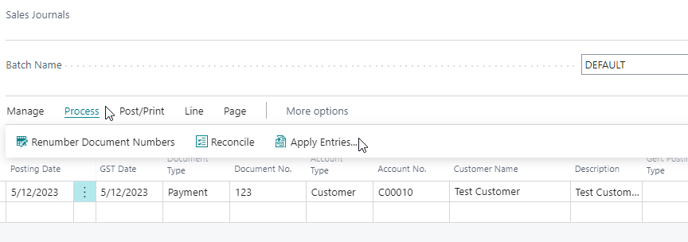

- Search for and select Sales Journals at the top right-hand corner of the page.

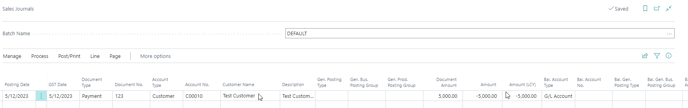

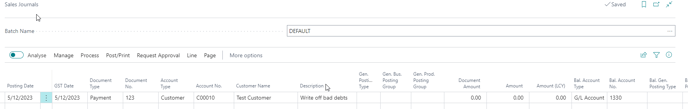

- Update the following information in the Sales Journal for the required customer.

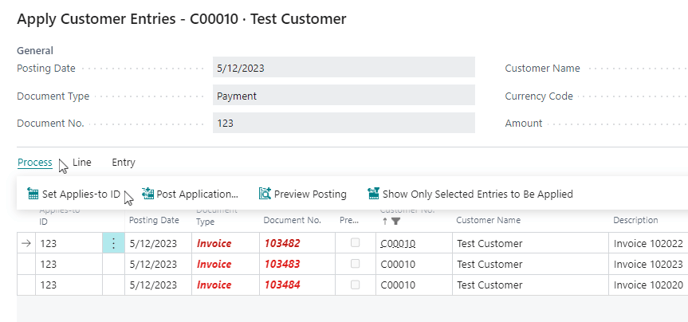

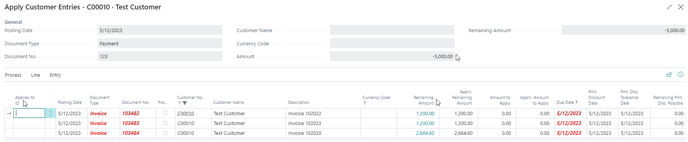

- The Apply Customer Entries page for the specific customer is displayed. Select which invoices you want to apply to write off as bad debt.

- Go back to the Sales Journals page and update the Description column to ‘Write off bad debts.’

Note: Write a description that will help you remember the reason for the journal.

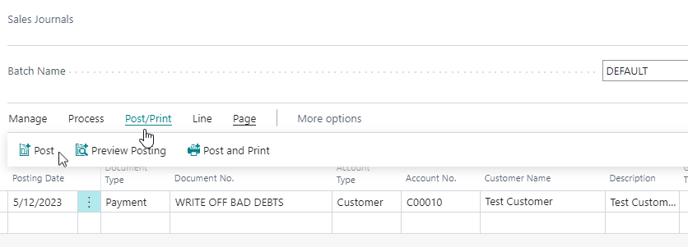

- Post the journal. Select Post/Print, then select Post.

- A message pops up asking if you want to post the journal lines. Select Yes to continue or select No to stay on the page.

- Select OK to continue after sales journal are posted successfully.

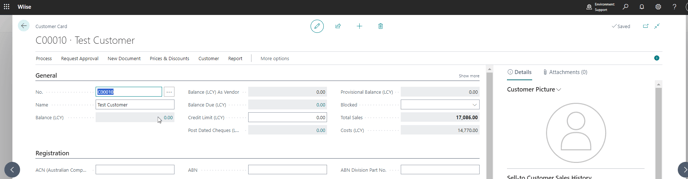

- Check the balance against the customerto whom you’ve applied to write off the bad debt.

- All debt has been written off for this customer if the balancing account is down to 0.00.

- Post the journal. Select Post/Print, then select Post.

How to recover written off bad debts?

If you later receive payment in part or full for a bad debt you’ve written off, you’ll need to record the payment recovered and reverse the original write-off.

What’s next?

Find out how to run an aged receivables report to understand how many customers owe the business money and how much of this is past due.

Need help?

If you have any questions reach out to support@wiise.com