Use Match Confidence fields in Payment Reconciliation Journal

Overview:

- Match transactions accurately with open customer and vendor entries

Why Use Match Confidence fields?

The Match Confidence field improves reconciliation accuracy by ranking automatic matches from high to low. This allows you identify which transactions need review, reducing manual work and improving efficiency during the reconciliation process.

How to Use Match Confidence fields?

Each line in the Payment Reconciliation Journal includes a Match Confidence value. This value reflects how closely the bank transaction matches an open entry based on document number, amount, customer or vendor name, and tolerance settings.

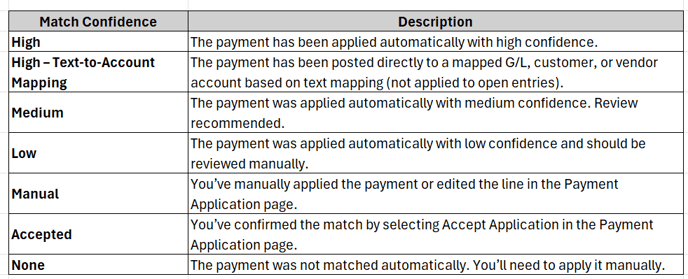

Here’s what each value means:

Here are steps to review or manually match a payment:

- Select a Match Confidence field on the relevant link in the Payment Reconciliation Journal.

- The Payment Application page displays, showing all possible matches.

- Review the suggested entries and either Accept Application or Remove Application as needed.

- Once accepted, the Match Confidence status changes to Accepted.

- You can now confidently use match confidence fields to apply payments.

Note: Use manual matching when a payment covers multiple invoices or when the reference doesn’t match an existing document. You can apply one payment to several open entries in the Payment Reconciliation Journal through the Payment Application page.

Note: Search Entries to Apply via Manual Application where you can review and apply payments that were applied automatically to wrong open entries or not applied at all.

Then, review and Accept Applications or Remove Applications. Accepted Applications change the Match Confidence status to Accepted.

What’s next?

Find out how to use a Payment Reconciliation Journal.

Need more help?

No problem, that's what we're here for. Reach out to support@wiise.com anytime you can't find what you're looking for.