Set up Direct Debit

Overview:

- Collect money directly from your customers’ nominated bank account via Direct Debit.

- Set up Direct Debit with your bank account.

Note: Direct Debit is supported by any bank that can process an ABA (Australian banking association) direct debit file.

Why set up Direct Debit?

Direct Debit lets you collect money that is owed to your business, directly from your customers' nominated bank accounts. You'll need to set up a Direct Debit facility with your bank before you can obtain customer authorisation and process Direct Debit payments.

Note: Before you set up your bank for Direct Debit, make sure your bank can process ABA Direct Debit files. Contact your bank to set up a Direct Debit facility. You can set up direct debit for your existing bank account in Wiise or set up a new bank account if you don't have one.

How to set up Direct Debit?

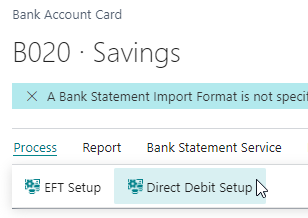

- Select the bank account you want to set up for Direct Debit. You’ll be directed to your selected Bank Account Card.

- Then, select Process, followed by Direct Debit Setup from the Bank Account Card menu.

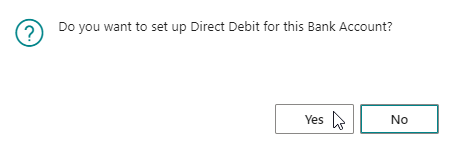

- You will be prompted with the following message Do you want to set up Direct Debit for this Bank Account? Select Yes.

Note: You will only get this message when attempting to setup direct debit for the first time for a bank account. - You’ll need to fill out the below fields:

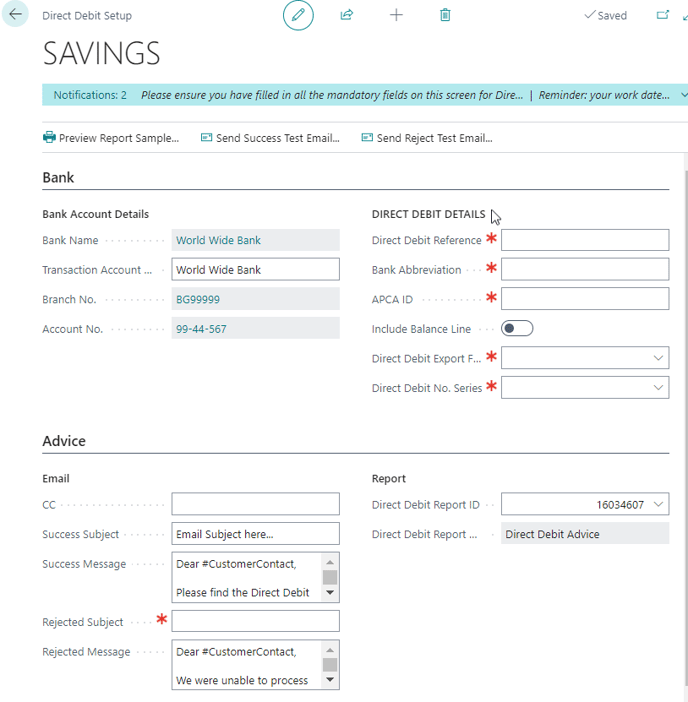

-

- Bank Account details (these are pre-filled).

- Transaction Account Description: This is what may appear as part of the transaction text in your customers’ statements.

- Direct Debit details: Fill in the mandatory red asterisks.

- Direct Debit Reference: This reference appears on the payee’s bank statement. You can override this using the Direct Debit Reference field on the customer card.

- Bank Abbreviation: This is pre-filled with the approved financial institution abbreviation. For example, the Commonwealth Bank of Australia's abbreviation is CBA.

- APCA ID: the six-digit APCA ID or Direct Entry User ID. If in doubt, you can ask your bank for advice. Your business will usually have its own APCA ID for Direct Debits.

- Include Balance Line: Does your bank need a Balancing line in the ABA file? Check with your bank if you're not sure.

- Direct Debit Export Format: The only format currently supported is Direct Debit ABA files and this should be already selected.

- Direct Debit No. Series: This is the sequential number series used for Direct Debit documents.

- Advice emails can be sent to customers to let them know about the debits and whether they were successful.

- CC: Enter an email address here to receive a copy of all advice emails you send. This can be helpful for troubleshooting or checking the email format when you set them up.

- Success Subject: This is the subject template for a successful direct debit advice email.

- Success Message: This is the message body for a successful direct debit advice email.

- Rejected Subject: This is the subject template for a failed direct debit advice email.

- Rejected Message: This is the message body for a failed direct debit advice email.

Tip: You can use the variables from the list below to complete each email. For example, Dear #CustomerName by #CompanyName reference #DDNo.

- #CustomerName: This is the Company name of the customer you're sending the advice to.

- #CustomerContact: This is the contact's name of the customer you're sending the advice to.

- #DDNo: The Direct Debit Document Number of the batch this email relates to.

- #CompanyName: Your company's name.

- #CompanyEmail: Your company's email.

- #CompanyPhone: Your company's phone number.

- #Username: The user creating the advice emails.

- #DDAmount: The amount of the direct debit transaction.

- Report: Advice emails include an attachment that summarises the transactions. Wiise creates a PDF report from the selected template. The customer's email address will be used to send the notice, so make sure these are correct on the customer card.

- Report ID: The Report Template ID for direct debits.

- Report Name: The name of the selected direct debit report.

- Bank Account details (these are pre-filled).

- Your bank account is now set up for Direct Debit and is ready to use to collect money from your customers.

Note: You'll need to make sure you have a current and valid authority for each account you debit before processing the direct debit file for your customers. Check with your bank to find out how to collect the Direct Debit Request (DDRs) or Electronic Direct Debit Request (eDDR) authority forms.

The details of these forms aren't recorded in Wiise so you'll need to make sure these are valid before you export transactions for processing. Once you have received the signed Direct Debit Request (DDR) from the customer, you can go ahead and set up their bank account details.

What's next: If you want to collect payment from your customers via Direct Debit, you’ll need to set up the customer bank account in Wiise.

If you have any questions reach out to support@wiise.com