Prepare cashflow statements

Overview:

- Learn how to prepare cashflow statements

Why prepare cashflow statements?

A cash flow statement can help determine the liquidity of a business and predict its future ability to meet its financial commitments. It’s also known as a statement of cash flows.

How to prepare a cash flow statement?

Here are the steps.

- Determine the starting balance of cash and cash equivalents at the beginning of the reporting period.

- The value can be found on the income statement of the same accounting period.

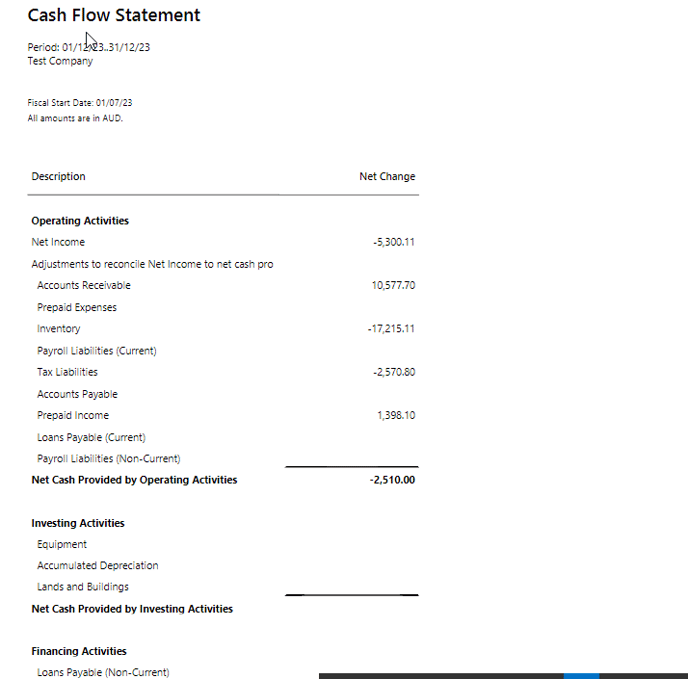

- Calculate Cash Flow from Operating Activities:

- Includes the cash receipts and cash payments such as accounts receivables, accounts payables, inventory, and prepaid accounts.

- Calculate Cash Flow from Investing Activities:

- These are your fixed assets which are long-term such as property, facilities and equipment.

- Includes acquisition costs, accumulated depreciation for the period, and any sale/disposal of an asset.

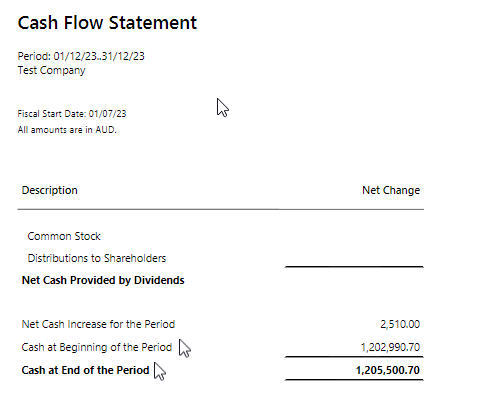

- Calculate Cash Flow from Financing Activities:

- This is your cash investments and borrowings.

- It includes your long-term liabilities and distributions to shareholders.

Note: When using GAAP, this section includes dividends paid, which may be included in the operating section when using IFRS standards. Interest paid is included in the operating section under GAAP but sometimes in the financing section under IFRS. - Determine the Ending balance of cash and cash equivalents at the close of the reporting period.

-

- The change in net cash for the period is equal to the sum of cash flows from operating, investing and financing activities.

Note: A positive net cash flow indicates a company had more cash flowing into it than out of it, while a negative net cash flow indicates the business spent more than it earned.

View your cashflow statements in Wiise.

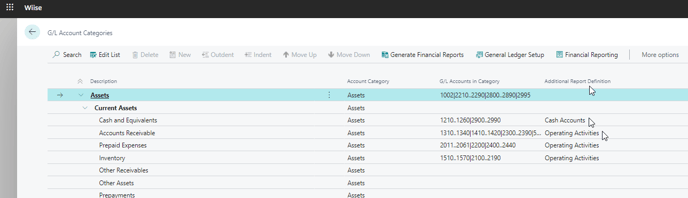

- Search for G/L Account Categories on the top right-hand corner of the Wiise page. The page displays.

Note: The values seen in the G/L Account Categories are assigned to multiple categories rolled onto the Balance Sheet and Income Statement. The cash flow activities as Operating Activities, Investing Activities and Financing Activities are reflected in the Additional Report Definition column.

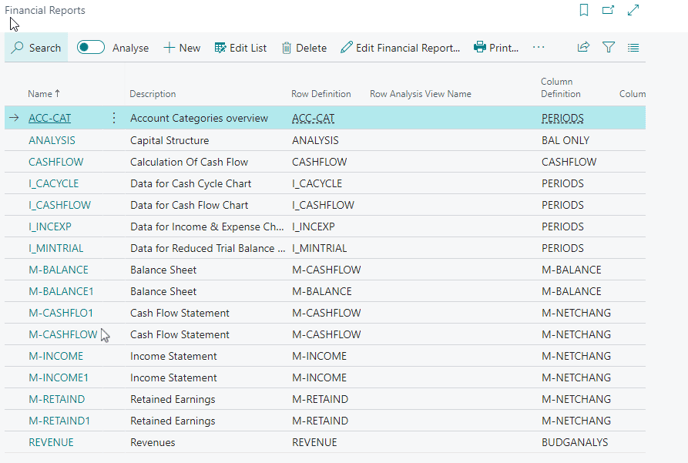

- To generate the cashflow statements, search for Financial Reports on the top right-hand corner of the Wiise page. The financial reports table displays a list of reports.

- Select the relevant financial report layout you want to generate.

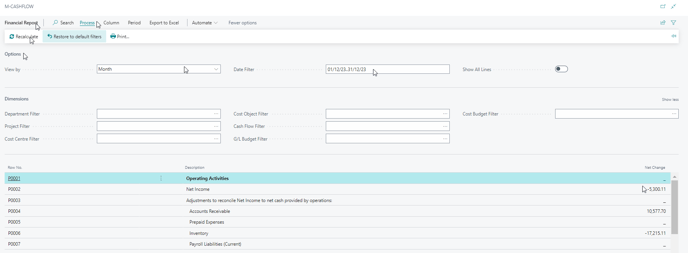

- Within the layout, update your Options. Apply filters and dimensions to the layout.

- Select Process. Then select Recalculate. The cash flow activities are generated based on your selection.

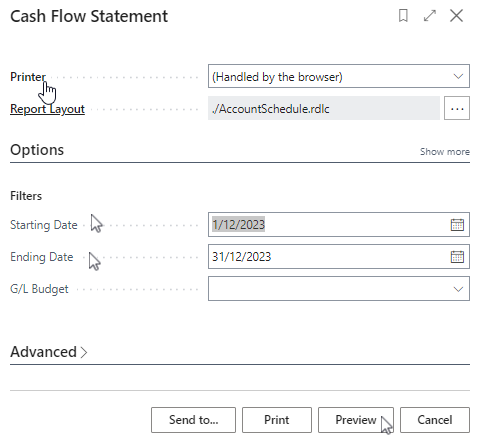

- Select Process. Then, select Print to preview the cash flow statement.

- Update the filters and select Preview to view the generated cash flow statement.

- The cash flow statement comprises of the net cash provided by the three cash flow activities, cash at the beginning of the period and cash at the end of the period.

- You’ve now prepared and generated the cash flow statements.

What’s next?

Now that you’ve reviewed and generated the cash flow statements, you can run other operations reports in Wiise.

Need more help?

No problem, that's what we're here for. Reach out to support@wiise.com anytime you can't find what you're looking for.