Working with Journals

Overview:

- Learn how to set up and post a journal.

Why work with journals?

Journals are used to record financial transactions or adjustments that you require to write entries. These journals are usually completed to accurately reflect the financial position and performance of your business. You can record manual adjustments such as accruals, prepayments, depreciation, and corrections to errors in transactions.

How to work with journals?

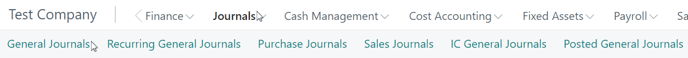

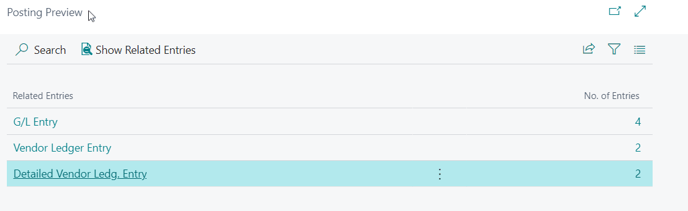

- In the Accountant role, select Journals. Then, select General Journals. The General Journals list displays.

- In the Business Manager role, select Finance, then select General Journals. The General Journals list page displays. You’ll see a list of journal templates set up for the different journal types.

Note: You can create new journal templates that allow you to set up parameters to control the different journal types. - Select an existing journal template or select +New to create a new journal template. The default journal template is selected.

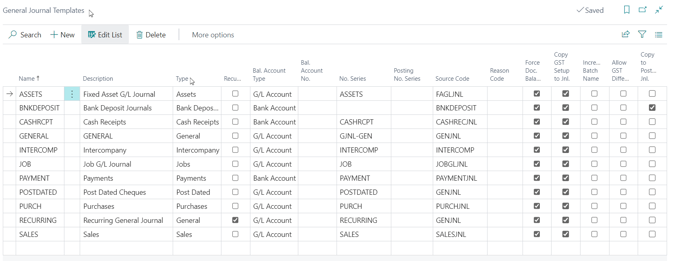

- Update the Document Type as an invoice.

- Select the Account Type as a G/L Account and specify the Account No.

- Specify the Bal. Account Type as a Vendor to balance out the journal line.

Note: Journals cannot be posted until they are balanced, regardless of whether the G/L or a vendor is used as the balancing account. If the journal entry is not balanced, it indicates an error in the entry that needs to be corrected before the entry can be posted. - To preview the action before you post your journal, select Post/Print. Then select Preview Posting.

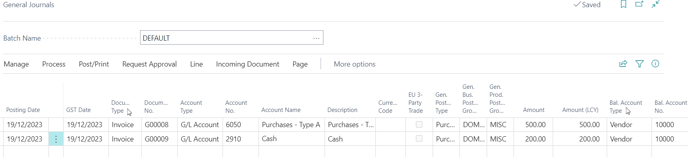

- Select the related entry that you'd like to view details of. Example, you can select G/L Entry to view the general ledger accounts the entries will post into.

Note: If you make a mistake, you can always reverse the journal entries. - Great. You’ve posted your journal.

What’s next?

Now that you’ve posted your journal, see how you can reverse the journal entries if you’ve made a mistake.

Need more help?

No problem, that's what we're here for. Reach out to support@wiise.com anytime you can't find what you're looking for.