Process a manual super batch payment

Overview:

- Find out how to process a manual super batch payment

Why process a manual super batch payment?

Processing a super batch payment streamlines the handling of employee superannuation contributions by consolidating them into a single transaction. This ensures accurate and timely payments to employees' super funds.

How to process a manual super batch payment?

Here are the steps to process a manual superannuation batch payment:

- Generate a manual super batch payment in Wiise Payroll. This report lists details of each employee’s contributions and the associated superfund.

- Organise payments for each super fund.

Note: Use the Small Business Clearing House on the ATO website to pay your employees’ superannuation if you have fewer than 20 employees. - Reconcile superannuation payments.

Note: After making payments, your bank statement will show these transactions. Instead of matching them to bills, assign them directly to your superannuation payable account in Wiise to reduce the outstanding balance. - Mark manual superannuation contributions as paid.

Note: Keep your records updated in Wiise Payroll by marking the superannuation payments you’ve made.

- Login to Wiise Payroll

- Select Business menu from the table of icons on the left-side corner of the page.

- Select Super Payments in the drop-down menu.

- Select New manual super payment batch on the top right corner of the page.

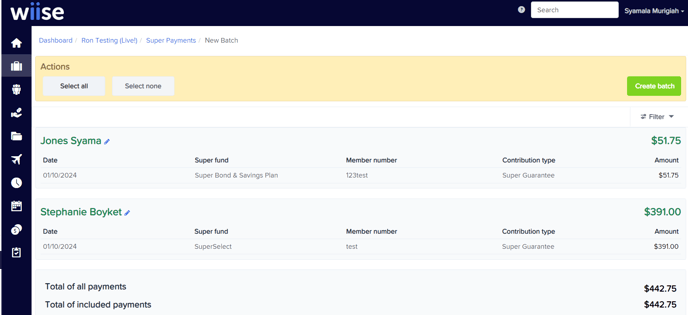

- The select super contributions for new manual batch payment request page displays.

- Filter the super contributions you’re applying to this manual batch payment.

- Date range: Filter to a specific date

- Pay Schedule: Select All or filter to a specific pay schedule.

- Contribution type: Select All or filter to a specific contribution type.

- Filter the super contributions you’re applying to this manual batch payment.

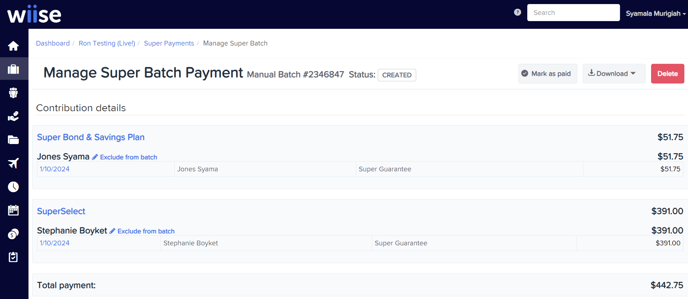

Note: Once the manual super batch is created, address action items that become available to the status of the batch. You might need to fix errors, re-validate and submit the batch again. You can download the payment report to assist you in making the super payment.

Note: The Delete button lets you remove the batch at any time. However, once deleted, the batch cannot be recovered, and any previous changes will be lost.

- Download the super batch payment in an excel, csv or pdf format.

- Proceed to process your super batch payment clearing house on your ATO approved clearing house.

- After you’ve submitted the batch payment file through the clearing house portal, verify that payments have been successfully processed and reconcile payments.

Note: Use your bank statements and the clearing house reports to reconcile the payments to confirm that all contributions have been accurately allocated to each super fund. - Select Mark as paid for your manual super batch in the Manage Super Batch Payment page.

- Keep detailed records of all superannuation payments and transactions for your business compliance and auditing purposes.

Note: When you integrate with Beam which is a Wiise Payroll chosen clearing house, you can manage and automate superannuation payments.

What’s next?

Find out how to send a notification to employees when you’ve finalised STP.

If you have any questions, please reach out to support@wiise.com