Post your GST Settlement

Overview:

- Learn how to post your GST settlement in Wiise

Why post your GST settlement?

When you post your GST settlement, you are recording the GST liabilities or GST credits of your business that you need to report to the tax authorities. This allows you to track and reconcile your GST transactions so you can report on your GST obligations and be compliant with the tax authorities.

Note: You must have completed the preparation of the BAS statements before you can process and post your GST settlement.

How to post your GST settlement?

Here are steps to calculate and post your GST settlement.

- Search for BAS Report List on the top right-hand corner of the Wiise page. The BAS Report List displays a list of all set up BAS Reports in Wiise.

- Select the BAS Report you’re working on.

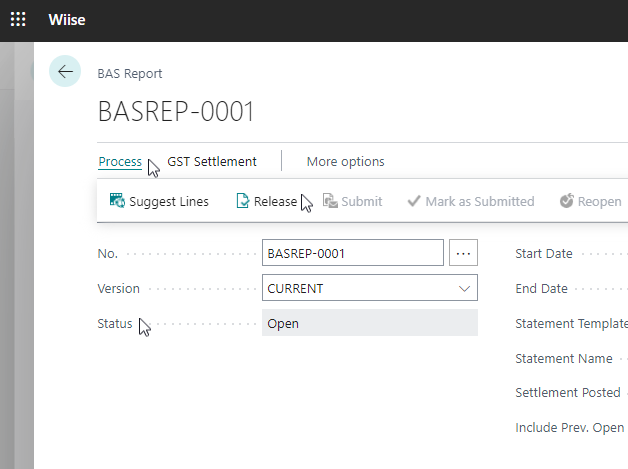

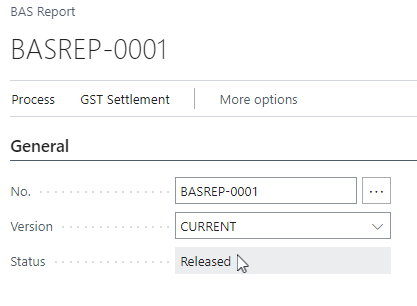

- Review the data in Report Lines and reconcile the amounts to your relevant G/L accounts. When the amounts are balanced, select Process, then select Release.

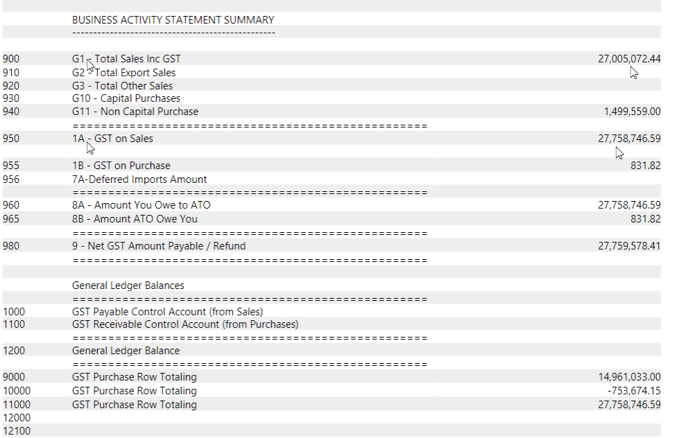

Note: Once the BAS Report is Released, you can print the GST statement and use the information to complete your lodgment in the ATO portal.

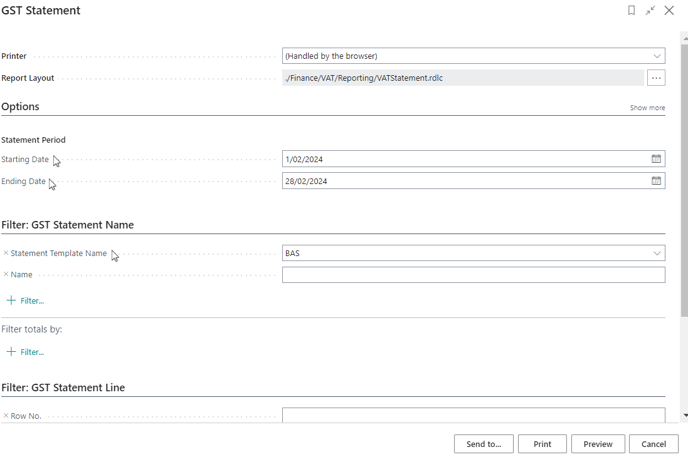

- To download or print GST Statements, search for GST Statements on the top right-hand corner of the page. Select the GST statements for report and analysis and then the GST Statement request report page displays.

- Update the Statement period you want to generate.

- Select BAS as the Statement Template Name.

- Then select Print.

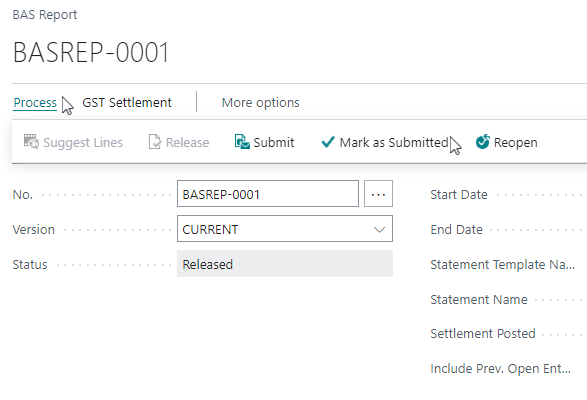

Note: After you’ve completed your lodgment in the ATO portal, you’ll need to update your BAS report status as Submitted. - Select Process, then, select Submit.

- Select Process, then select Mark as Submitted.

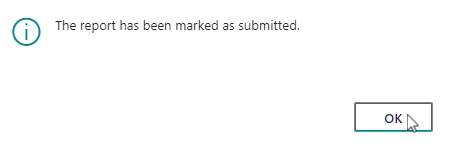

- A message box displays to inform you that the report has been marked as submitted.

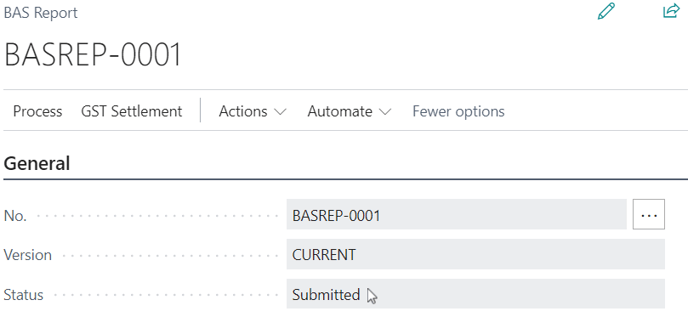

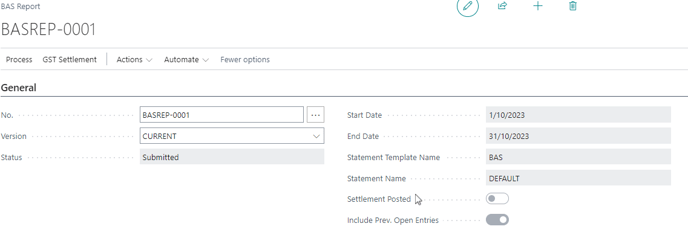

- The BAS Report status is updated as Submitted.

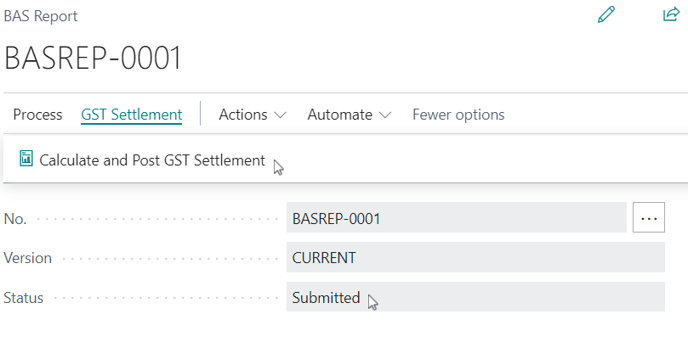

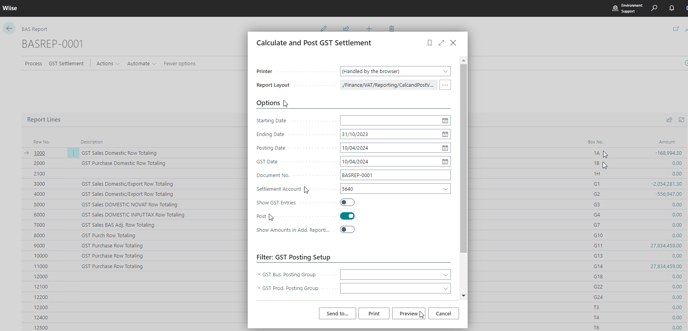

- Select GST Settlement. Then select, Calculate and Post GST Settlement.

- The Calculate and Post GST Settlement request page displays.

- In the Options section:

- The Starting Date and Ending Date are filled in based on the selections you made when you ran Suggest Lines. If Before and Within Period was selected in Suggest Lines, the Starting Date will be blank.

- The Posting Date is updated as of the date you generate this page. You can update the date here.

- Update the Settlement Account which will be the GL account where the GST Paid (from Gross Purchases) and GST collected (from Gross Sales) will be posted to.

- Enable the Post toggle field to allow Wiise to generate and post the settlement journals.

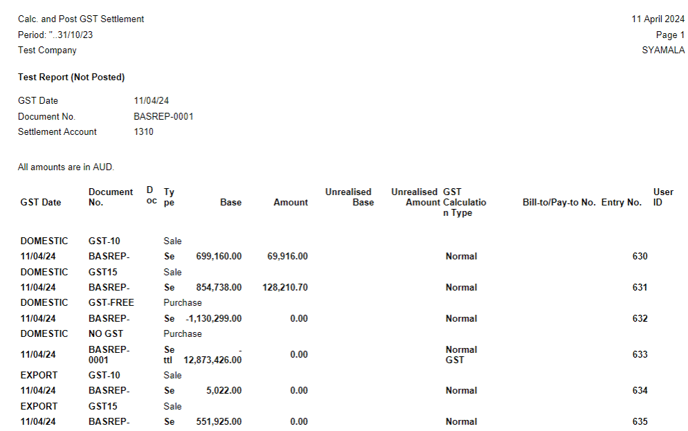

- You can select Send to, Print, or Preview the report. Select the Preview button to preview the Calc and Post GST Settlement report for the selected period.

- In the Options section:

- You’ve now generated the Calc and Post GST Settlement report.

- Once settlement has been posted to your gl accounts, the Settlement Posted toggle button will be enabled in your BAS report.

- You've now posted your GST settlement.

What’s next?

Find out how to submit your BAS Report to ATO.

If you have any questions reach out to support@wiise.com