Manage ATO settings

Overview:

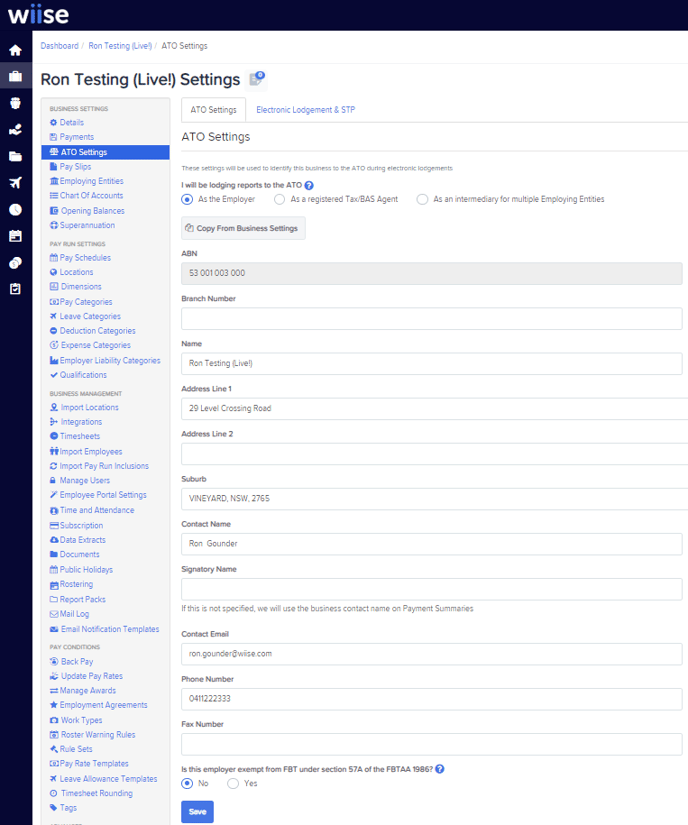

- Find out how to set up Australian Taxation Office (ATO) settings in Wiise Payroll

Why set up ATO Settings?

The ATO settings you detail in Wiise Payroll identify your business to the ATO during electronic lodgements. You need to select who will submit reports to the ATO for this business. The three options are the employer, a registered tax/BAS agent, or an intermediary for multiple employing entities.

How to set up ATO Settings?

- Select Payroll Settings from your homepage in Wiise Payroll.

- Then, select ATO Settings in Business Settings. The ATO Settings page displays.

Lodge reports to the ATO as the employer

- Select the checkbox As the Employer.

- Fill in the relevant fields:

- Branch number: The branch number is sometimes added to your ABN by the ATO and can be found on any official ATO documents. If you don't have one, this field is not required.

- Complete the Is this employer exempt from FBT under section 57A of the FBTAA 1986 checkbox.

- Select the Save button.

Lodge reports to the ATO as a registered Tax/BAS agent

- Select the checkbox As a registered Tax/BAS Agent

Note: Select this option if an external TAX/BAS Agent will submit reports to the ATO on behalf of your organization. Even if your business has multiple employing entities, select this option if a TAX/BAS Agent is managing your lodgements.- Complete the shown Tax/BAS agent details fields.

- Complete Is this employer exempt from FBT under section 57A of the FBTAA 1986? Select the appropriate checkbox.

- Select the Save button.

Lodge reports to the ATO as an intermediary for multiple employing entities.

- Select the check box As an intermediary for multiple Employing Entities.

Note: Select this option if the employer is handling all ATO submissions, even if your organization has multiple employing entities.- Complete the other intermediary field details.

- Complete the Is this employer exempt from FBT under section 57A of the FBTAA 1986 checkbox.

- Select the Save button.

- You’ve set up ATO settings.

Note: Wiise Payroll only requires the Signatory name if you want the name displayed on the income statement to be different from the contact's name within your business details.

What’s next?

Find out how to manage STP settings in Wiise Payroll.

If you have any questions, please reach out to support@wiise.com